Impress your clients and remain at the forefront of your industry by offering a solution to outdated and inadequate retirement benefits.

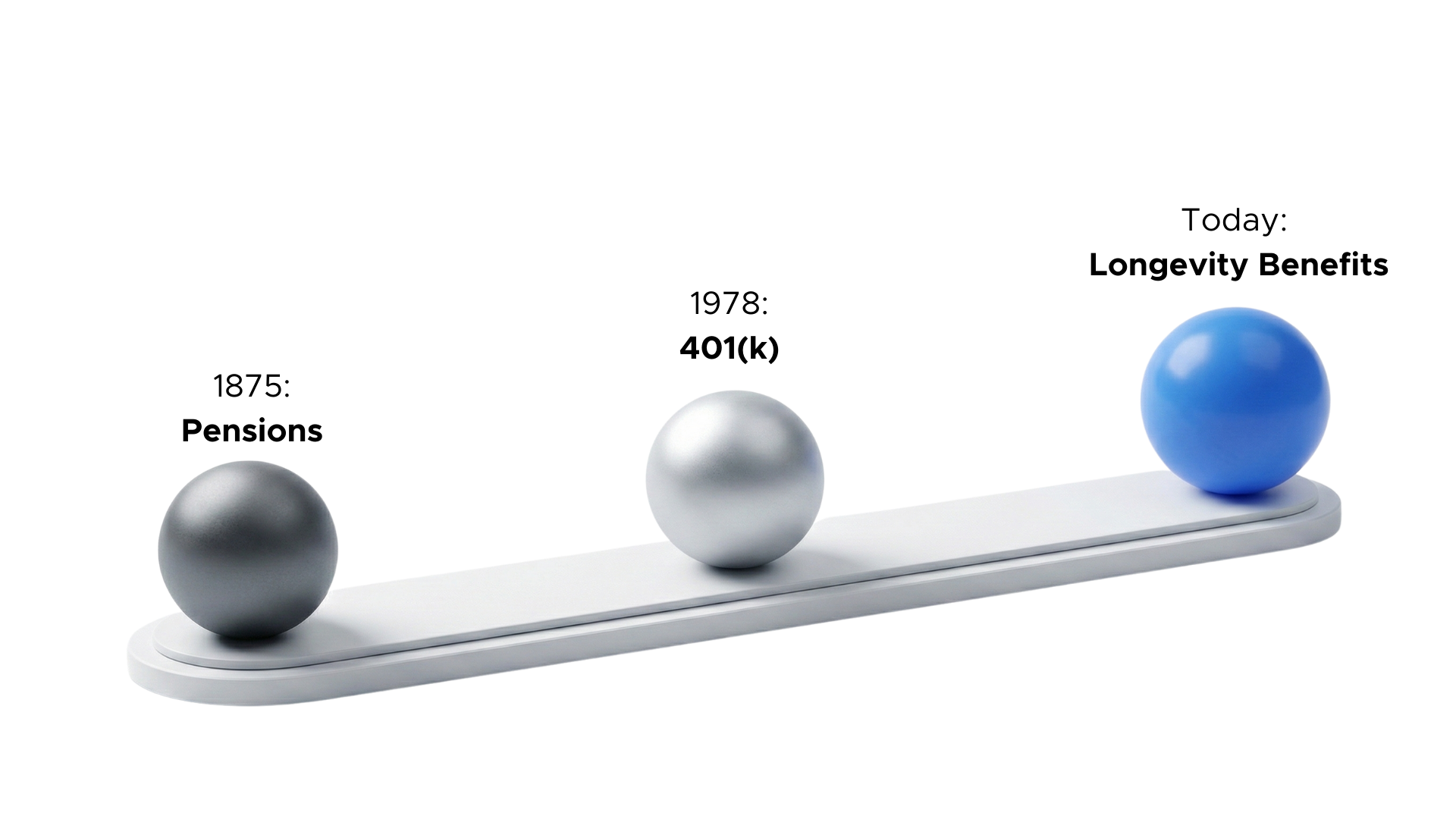

Employees are living longer, careers are spanning more decades, and retirement confidence is harder to achieve. Brokers who understand this shift can bring meaningful solutions to their clients.

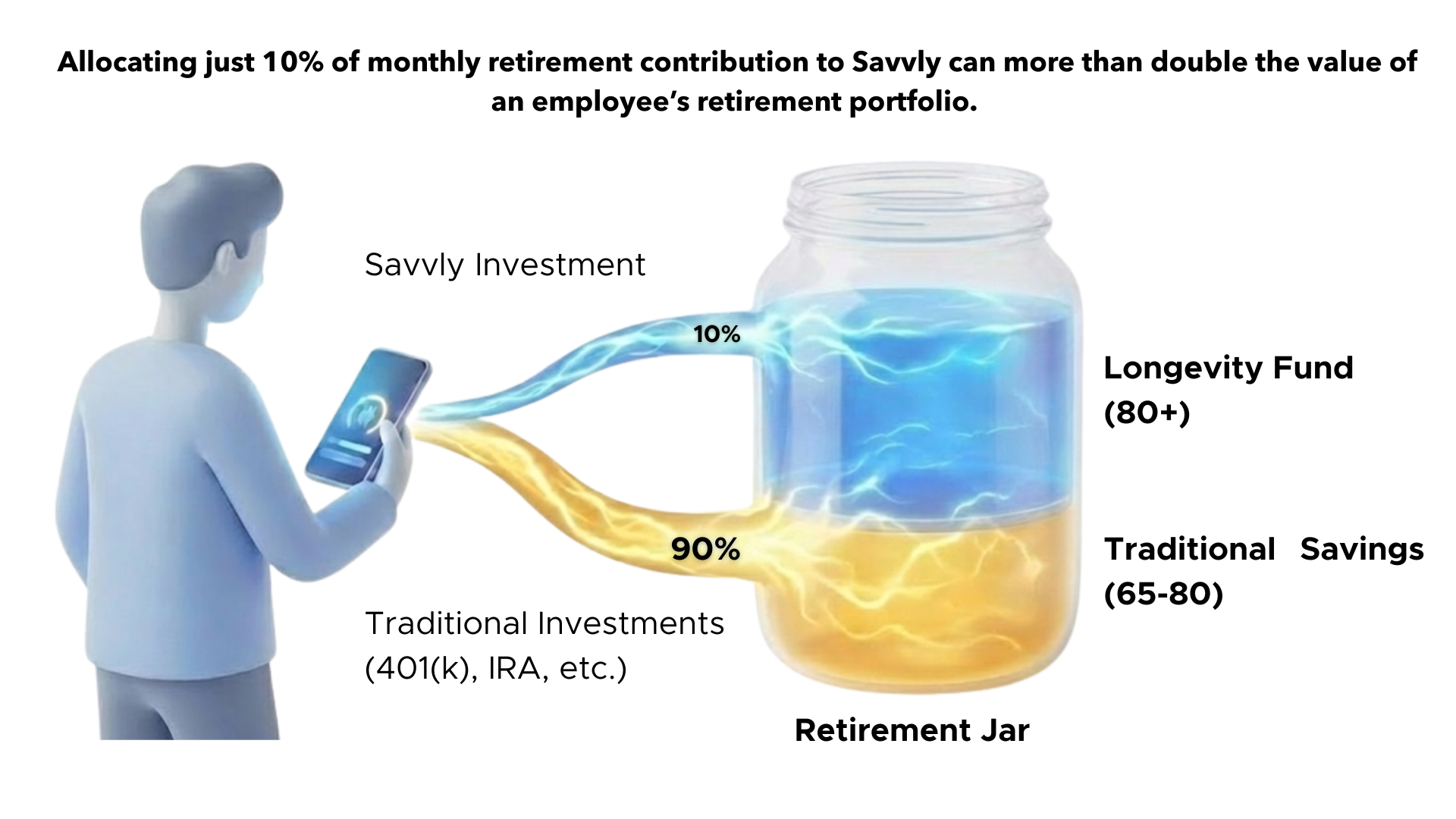

Hypothetical illustration. See Assumptions & Disclosures.

Hypothetical illustration. See Assumptions & Disclosures.

Longevity is becoming a priority. Stand out in a crowded market with a strategic benefit that fills the retirement gap, elevates your advisory value, and helps clients navigate a longer-living workforce without disruption.

Clients are looking for solutions beyond the 401(k). Savvly lets you offer something structured, human, and innovative without changing existing systems.

Savvly plugs into existing systems as a clean, low-lift upgrade that instantly modernizes your clients’ benefit offering.

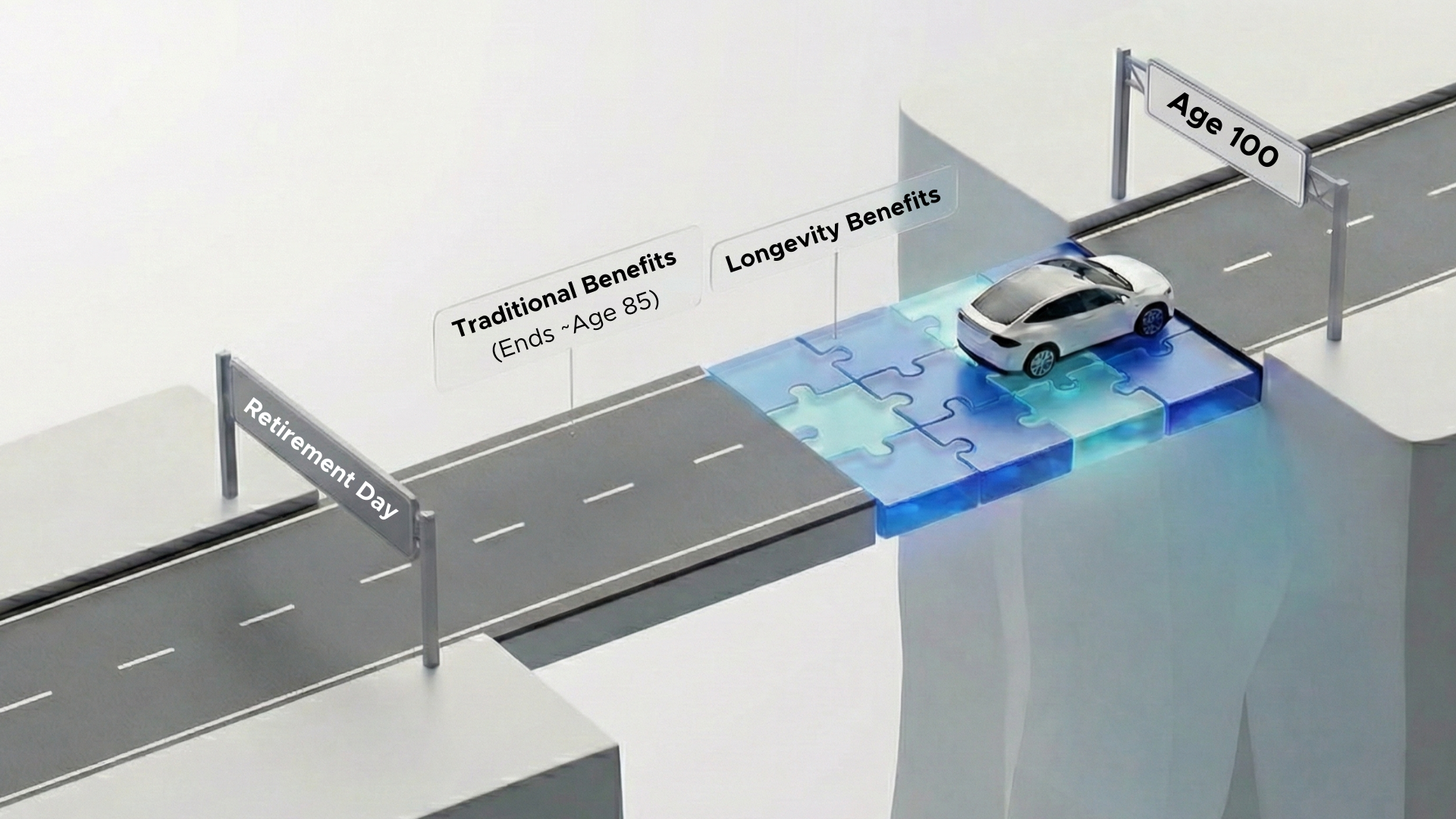

Savvly helps employees retire on time, reducing workforce drag and giving HR teams a meaningful lever for mobility and planning.

Hypothetical illustration. See Assumptions & Disclosures.

Savvly works with the platforms your clients already use, making setup fast, easy, and frictionless. There’s no need to overhaul systems or retrain teams. We plug right into your clients’ existing payroll and HR platforms, and handle the onboarding so you don’t have to.

Savvly gives you a future-ready benefit that stands out immediately and fits exactly what HR leaders need for their companies.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value. Savvly products involve risk including possible loss of principal. Past performance does not guarantee future results. This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own advisors regarding your specific situation.